Users who open a SafePal Banking Gateway account will now enjoy zero deposit and on-ramp fees. Learn more

•

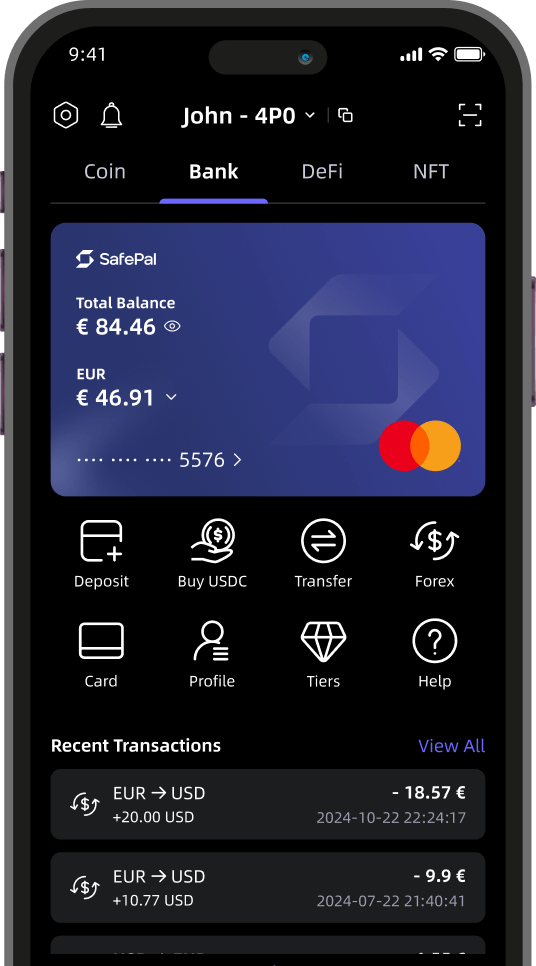

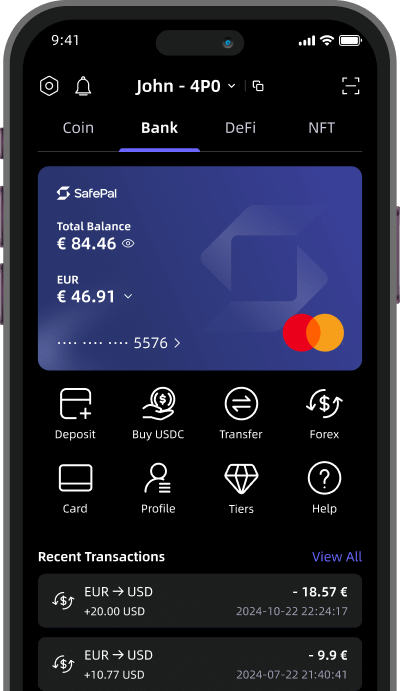

Fully compliant Swiss IBAN account1

•

Enjoy seamless and swift transfers between global bank accounts

•

Customize your spending limit for advanced security2

•

Zero fees for account setup and management, as well as bank transfers3

•

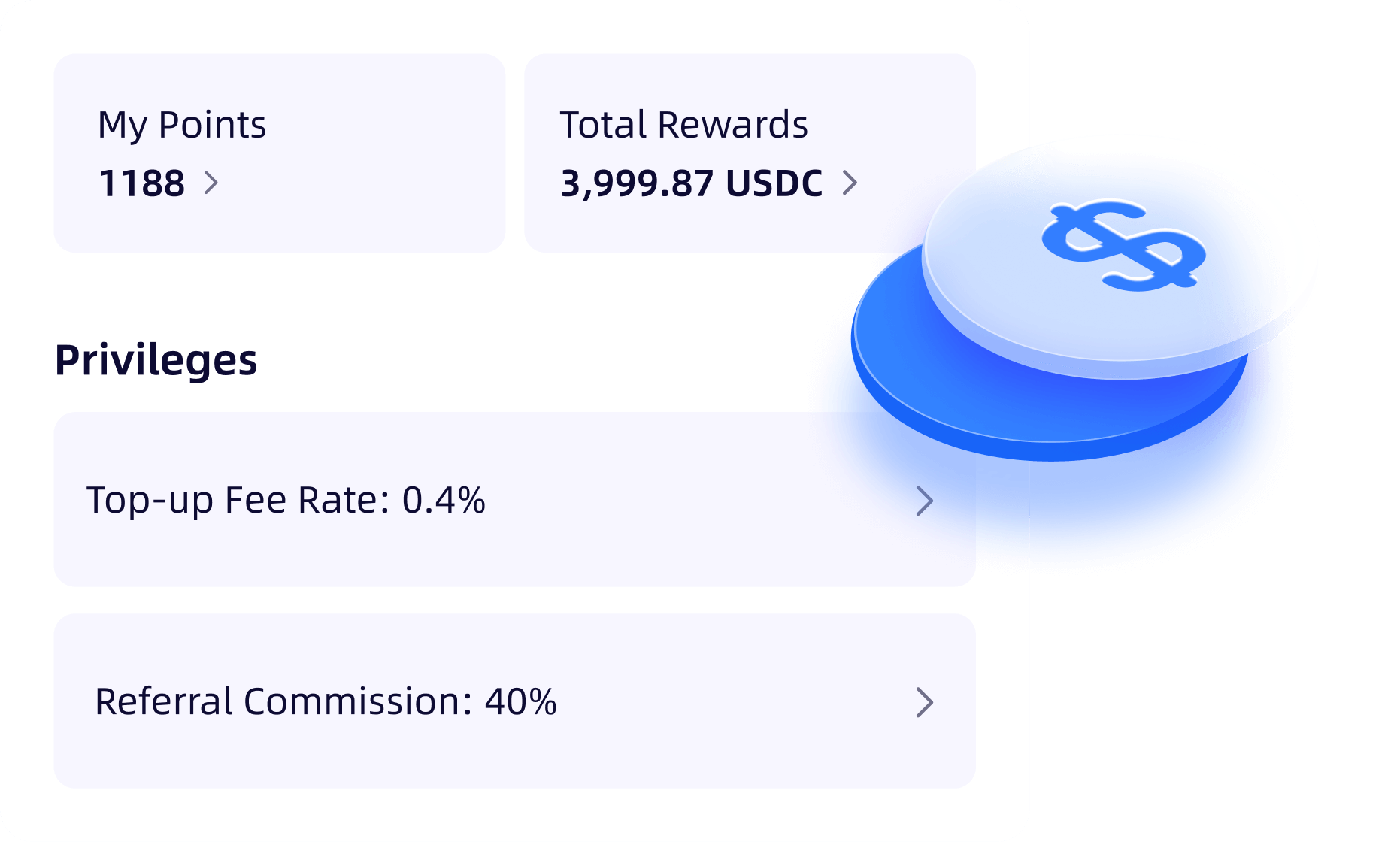

The most competitive crypto top-up fees, with rates as low as 0.4%4

•

Transactions are made on the Arbitrum network, which has affordable gas fees5

•

No credit checks or mandatory staking of assets for account eligibility6

•

Use your account and card instantly upon approval

•

Responsive and dedicated email support7

•

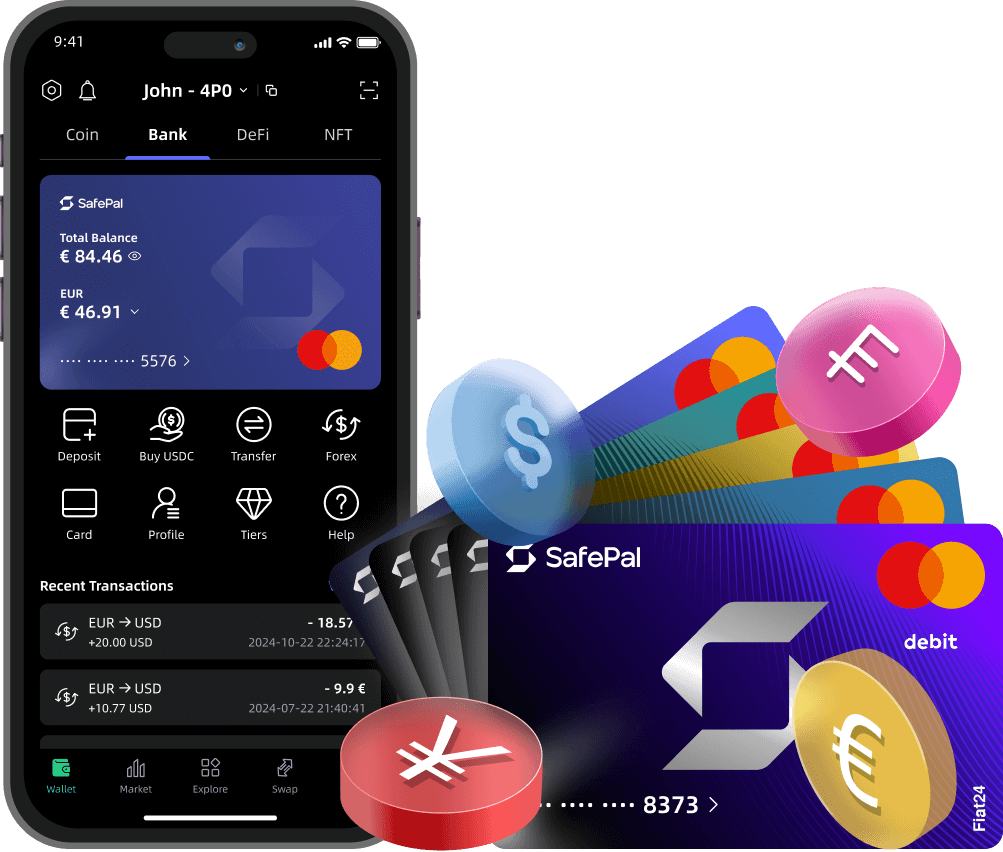

Link your account with virtual Master debit cards which are accepted at 40M+ merchants, including all Master debit card supported platforms

•

Top up your account with crypto across 40+ blockchains into USDC and Fiat for convenient usage8

•

Spend crypto via popular and established payment platforms like Paypal, Apple Pay, Google Pay, Samsung Pay, and more

•

Enjoy up to 40% referral commissions indefinitely on all top-up fees from referred accounts9

•

Unlock exclusive privileges by making deposits, referring accounts, and staking SFP10

Frequently Asked Questions

For Mastercards, the limit for contactless payments is 1,600 EUR per day and 5,000 EUR per day for other payment methods. The monthly consumption limit is the same as the transaction limit.

For more FAQs and user guidelines, visit our Help Center

1. The Swiss IBAN account and banking gateway service is offered in collaboration with Fiat24, which solely handles the compliance and licensing aspect. Learn more on the official Fiat24 website here.

2. The spending limit refers to the total accumulated amount that can be spent by users for their Mastercards. Please refer to the guide here on how to adjust them.

3. All fees are disclosed transparently while using the service. Crypto swap fees, account top-up or deposit fees, and fiat exchange fees may apply. While SafePal and Fiat24 do not charge bank transfer fees, there may be charges by other banks when making transfers from or to those bank accounts. A spread also applies when swapping cryptocurrencies. For more information, please visit our Pricing and Fee disclosures.

4. Top up rates and referral commissions differ between account tiers. The competitive rates highlighted are based on the highest account tier. For more information on account tiers, please refer to the guide here.

5. Gas fees are subject to network usage and are not controlled by SafePal. They may be higher during peak network usage or congestion. Learn more about gas fees in the guide here.

6. As required by banking license and compliance requirements by regulators, there are KYC and onboarding processes for eligible users. Learn more about the requirements under the FAQ section here.

7. Users can reach out for support and queries via the dedicated channel here. This system is to protect the privacy and security of users and minimize the likelihood of impersonators and scammers.

8. $USDC is the default top-up cryptocurrency to safeguard users from market volatility, and the execution or transactions on-chain may be affected by network congestion or usage. Learn more in the guide here.

9. All imagery is for illustrative purposes only, benefits and rewards may vary and be adjusted at the discretion of SafePal and Fiat24.

10. For a breakdown of the account tiers and privileges, users can refer to the guide here.